It’s no secret;

Women’s financial power is growing.

✓ Women control more wealth than ever before

✓ Women are breadwinners or co-breadwinners in a majority of homes

✓ Women are on track to inherit the majority of $30 trillion in intergenerational wealth over the next decade

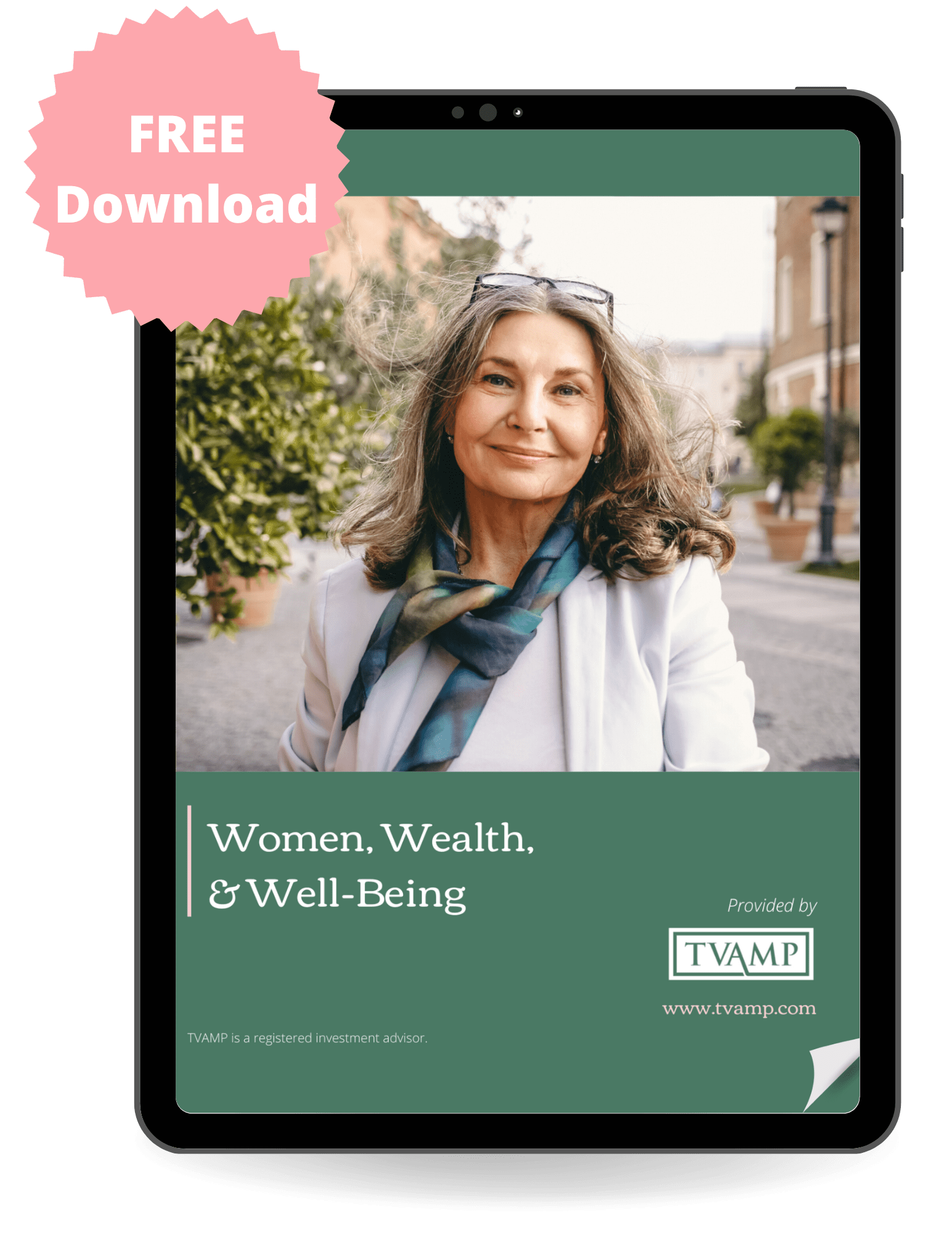

It’s time to discover the tools and knowledge you need to feel more confident with your finances in our new, free guide: Women, Wealth & Well-Being.

It’s no secret;

Women’s financial power is growing.

✓ Women control more wealth than ever before

✓ Women are breadwinners (or co-breadwinners) in a majority of homes

✓ Women will inherit majority of $30 trillion in intergenerational wealth over the next decade

Discover the tools and knowledge you need to be more confident with your finances in our free guide: Women, Wealth and Well-Being.

Unfortunately, women face many challenges on their path to financial security.

Women must overcome the “gender pay gap,” juggle work and their children’s schedules, face higher medical expenses, outlive their spouse, struggle with financial confidence, and more.

At TVAMP, we believe women deserve to:

Be financially secure

Invest to fulfill goals

Feel confident about money

Understand their investments

Be debt free

Receive straightforward advice

Be financially secure

Invest to fulfill goals

Feel confident about money

Understand investments

Be debt free

Receive straightforward advice

15 Minutes, No Obligation

Meet the Women Wealth Advisors of TVAMP:

Melissa is a seasoned Wealth Advisor with 11 years of experience. As a working mom, she understands the importance of managing wealth in a way that supports a fulfilling family life. Melissa loves to help her clients feel confident about their money. Melissa’s favorite part of her work is building long-term relationships with clients and plugging them into a “team” of financial professionals to fully optimize their finances.

Jill is an advanced Wealth Advisor with over 22 years of experience. Jill’s mom is her biggest role model. Before her mom passed away in 2022, she battled Alzheimer’s for over a decade. Jill developed a deep understanding of the challenges involved in caring for elderly parents. Jill always listens attentively to her clients so she can tailor recommendations to meet their specific needs, rather than offering a one-size-fits-all approach.

5 benefits of working with a woman advisor:

#1

Natural ability to understand what is important to women, and why.

#2

Uses relatable language (versus financial jargon) in order to prevent any confusion.

#3

Motivates and coaches you to encourage the best results possible.

#4

Focused education to help you understand your different options.

#5

Carefully listens to you to learn about your life, family, aspirations, and emotions.

#1

Better understanding of what is important to women, and why.

#2

Relatable language that avoids jargon to avoid any confusion.

#3

Accountability and coaching to encourage the best results possible.

#4

Focused education to help you understand your different options.

#5

Carefully listens to you to learn about your life, family, aspirations, and emotions.

Free guide

Women, Wealth,

& Well-Being

What you’ll learn:

The rise of women’s power

Uncover what wealth means to you

Find the right level of investment risk

5 steps to build your foundation

How It Works

Our process helps affluent women get their financial life in order and stay on the right track to pursue their life goals.

Resources for Women

Evening to Replenish

A fun gathering for purpose-driven women on the 3rd Thursday of each month at Fox Den Country Club.

Learn More

Once you become a client, we’re always here for you.

Jill Bertke, CFP®

Wealth Advisor

From the Blog

Do you still need a living, breathing financial advisor to get good financial advice?

In today’s climate of one-page financial plans, bargain-basement fund pricing and automated investment management tools, you may wonder… Spoiler alert: You do. But with a twist.

Read More