We understand it’s natural for people to feel anxiety when the markets are going down. That’s part of investing.

Josh Klinger, JD, AAMS® is a Wealth Advisor at TVAMP. He believes that wealth isn’t a privilege; Individuals and families must make consistent, conscientious financial decisions and exercise patience. He is actively involved in the community and enjoys working out.

Summary:

- We are here as a resource or sounding board if you need guidance

- Research doesn’t support the coronavirus being a global endemic

- We continue to recommend a well-diversified portfolio

- Equities have tumbled as the spread of the Coronavirus outside of China stoked fears of a prolonged global economic slowdown

- A corrective phase is upon us, but past epidemics suggest this will prove to be a better entry point than exit for intermediate and long-term investors

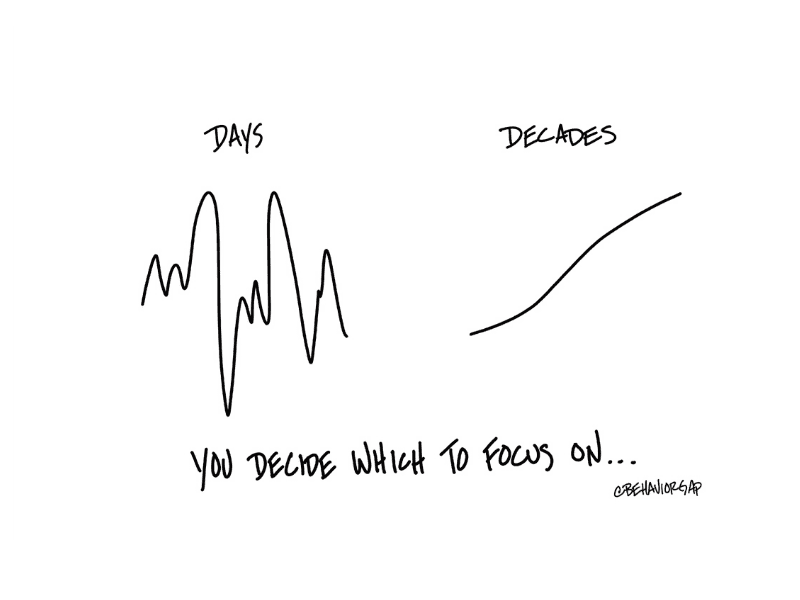

We are well aware of the situation and what’s happening in the financial markets. We understand it is natural for people to feel anxiety when their accounts are going down. This is part of investing. History has shown that staying the course and remaining invested in both prosperous times and treacherous times will pay off.

John Nicholls, a clinical professor in pathology at the University of Hong Kong and expert on coronaviruses (he’s been studying coronaviruses for 25 years) was interviewed at the end of February regarding the situation and here’s a quick summary: “Look at fatality rates outside of Wuhan (the epicenter of the virus) – it’s below 1%. The correct comparison is not SARS or MERS but a bad cold that kills people who already have other health issues. This virus will burn itself out in May when temperatures rise. Wash your hands.”

I agree with him.

What is the coronavirus?

It is a member of the coronavirus family called Covid-19. It has come from animals. Most of those initially infected either worked or frequently shopped in the Huanan seafood wholesale market in the center of the Chinese city. The virus exhibits many symptoms similar to your common flu – coughing, fever and breathing difficulties.

A History of Epidemics

As of February 25, 2020, there have been a reported 79,000 cases and 2,623 deaths relating to the coronavirus, making the death rate after catching the disease around 2%. As a comparison, the SARS epidemic in 2003 had a mortality rate of around 8%. This appears to be more of a severe cold rather than a global epidemic. Recovery from the coronavirus depends largely on the strength of the immune system. Many of those who have died were already in poor health.

The Science Behind the Virus

According to Dr. John Nicholls, there are three things the virus does not like: 1) sunlight; 2) temperature and 3) humidity. Sunlight will cut the virus’s ability to grow in half so the half-life will be 2.5 minutes and in the dark, it is about 13 to 20 minutes. It’s believed this is why we haven’t seen the virus spread to Australia and the southern hemisphere because both have lots of sunlight and are in the middle of summer. Wuhan and Beijing the two most affected regions remain cold.

We are likely to see continued reporting of the coronavirus across the globe, however, early scientific research doesn’t support this being a global endemic. It most likely will be a hit and run just like SARS. People and news outlets will talk about this being the “lethal virus” but at this stage, the evidence doesn’t support such a claim. Currently, it’s a really bad cold which can cause problems in people. Seasonal influenza causes deaths in the elderly every year, yet we don’t call it “the lethal influenza.” Wash your hands, practice good hygiene, take care of yourselves and let this virus burn itself in about six months.

Market/Economic Reactions

Stocks began pulling back late February on news of the virus spreading beyond China. Stocks continued their fall to start the week as the Dow fell more than 2000 points in three days. Stocks slid another 1170 points as of the close of business on last Thursday, marking an almost 3000-point loss over the last five days. The major economic impact has been on the supply side, with disruptions in transportation and delivery. We’ve seen companies like Apple, Nike and Microsoft alerting investors that revenue numbers for the first quarter may not meet expectations as the virus has slowed international productivity. The virus will inevitably impact the earnings of some companies in the short-term, however, we continue to expect earnings to grow at a modest pace for the remainder of 2020. The market doesn’t operate in a vacuum. It’s not going to go up every day, month or year. Events like the Coronavirus are unexpected and incapable of being planned for. We continue to believe this virus is not likely to cause a national endemic, forcing the economy into a recession.

News Coverage

One of the more frustrating parts of our job is how the national media reports news. If you turned on any major news network over the past week it seems very “doom and gloom” with regards to this virus. Headlines are often sensationalized. And unfortunately, social media has influenced the way the world views the news. We are driven by what will get the most clicks, likes, etc. rather than an objective view of the facts and possible outcomes. When viewing the news, please proceed with caution. The truth probably lies somewhere in the middle between the “end of the world” rhetoric and the other side saying “don’t worry, this is nothing.”

Carl Richards behaviorgap.com

We are here to speak further if you have questions about your portfolio, the market, or whatever else is on your mind. Please use us as a resource in this time of uncertainty.

Stay Invested,

Josh