Yesterday, we saw the first half of the year come to a close. And it’s been an ugly one for the markets.

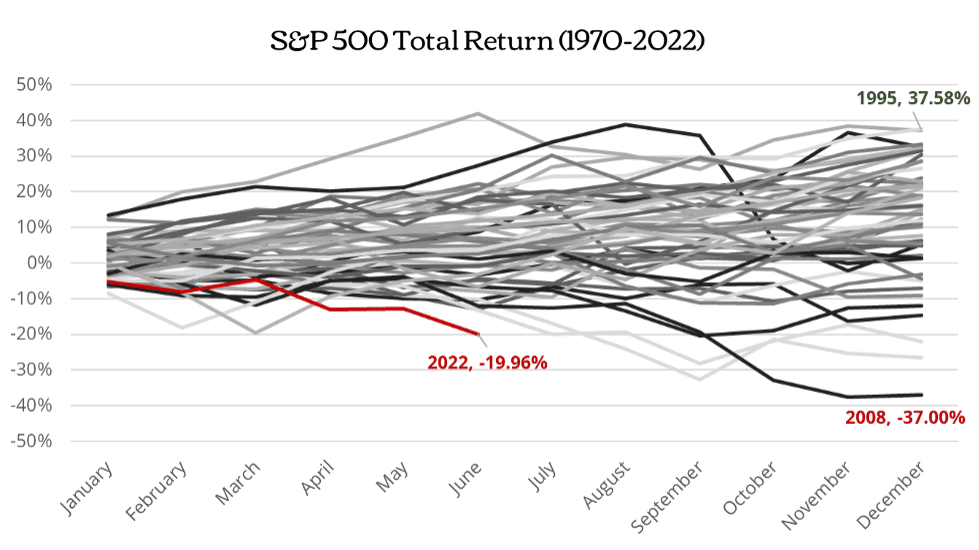

On June 13th, the S&P 500 closed in bear market territory (defined as a 20% decline from its previous high) and the index ended the month down 19.96% since the start of the year.

To put things in perspective, this is the worst start to the year for the S&P 500 since 1970.

Making matters worse are bonds. As of June 30th, the Bloomberg US Aggregate Bond index was down 10.35% since the start of the year. For perspective, the worst year on record for this index before 2022 was down 2.92%

This is the worst start of the year for the bond index since 1980.

In a fascinating research note from Deutsche Bank AG, their strategists estimate this could be the worst year for treasury bonds since 1788…though data this old is much more difficult to calculate. 1

Both stocks and bonds are having their worst year for decades and we are officially in a bear market. So, what do we know about bear markets?

When was the last bear market?

Not that long ago. The most recent bear market for the S&P 500 was during COVID in 2020. In fact, there have now been 11 bear markets since 1950. There have also been 5 “near bear” markets in which stocks have fallen 19% or more.

People often forget markets fell by 19% in 2011, and 2018.

How long do bear markets last?

On average, the bear and “near bear” markets listed above lasted for 11 months from peak to trough. The current bear market has not yet “bottomed.”

What is the average market decline during a bear market?

On average, the S&P 500 has declined by 29.8% during the bear and “near bear” markets since 1950.

What are stock returns after a bear market?

The good news is a year after the S&P 500 moves into a bear market, stocks do pretty well, up an average of nearly 15%. But that’s not always the case. In the bear markets of 1973 and 2008, the market continued to perform poorly.

But here’s the good news…

Every time in history that the S&P 500 has entered a bear market, it has always eventually achieved new highs. Wars, sky-high inflation, recessions, bubbles, pandemics, geopolitical events, policy mistakes, and more have all happened over this time, but stocks have always come back eventually to new highs. We do not think this time will be any different.

Here’s what we need to remember

- Equity markets have spoiled investors in the past 3 years. From 2019 to 2021 the S&P 500 returned 31.5%, 18.4% and 28.7%. These are exceptional equity returns.

- The stock market is one of the only places things go on sale and people run out of the store screaming. Bear markets can prove to be an excellent opportunity to invest when things are “on sale.”

- Doing the right thing isn’t always easy. Avoid making decisions about your long-term investment strategy based on short-term volatility

- To achieve equity like returns investors must accept equity like volatility. Fluctuation in investment values is the price of admission for investing.

Data sourced from Morningstar & LPL Financial Research:

- https://www.bloomberg.com/news/articles/2022-06-22/deutsche-bank-looks-back-three-centuries-for-parallel-to-us-rout