Investing comes with risk.

In fact, risk and reward are inherently tied. Generally speaking, the riskier the investment, the greater the expected return. And risk can come in all shapes and sizes.

The risk people are most familiar with is volatility.

The price of investments moving up and down – often violently – and account statements that look really good, or really bad.

We usually don’t remember when account statements look really good, we just go on with life. But when accounts go down and markets are ugly, it’s easy to react and make decisions based on emotion. This is “loss aversion”.

Our brains are wired such that losses are much more painful than the euphoria of an equivalent gain.

2022 has been a painful year for investors.

Even conservative investors with large allocations to bonds have not been safe.

With all the negative news in the media, and an economy that continues to struggle, we often get asked by clients “Why don’t we sell our investments and wait until things get better?”

3 reasons the above doesn’t work:

1) You have to be right twice.

You have to know when to sell, and when to buy again. Even the most seasoned investors are unable to predict when the market has hit a peak and when it reaches a bottom. Often investors sell based on fear and reinvest when everything looks much better, thus missing the recovery in prices altogether. Selling low and buying high is the opposite of prudent investing.

2) Patience usually pays off.

Warren Buffet famously wrote that the stock market is “a way for the impatient to transfer money to the patient.”1

From 2002 to 2021, the S&P 500 annualized gain was 9.5%. The annualized gain of a balanced portfolio of 60% stocks and 40% bonds was 7.4%. However, the average investor’s return was only 3.6%.2 Why the gap in performance? In part because when stock prices begin to fall, investors become driven by fear and make decisions that may not be in their best interest.

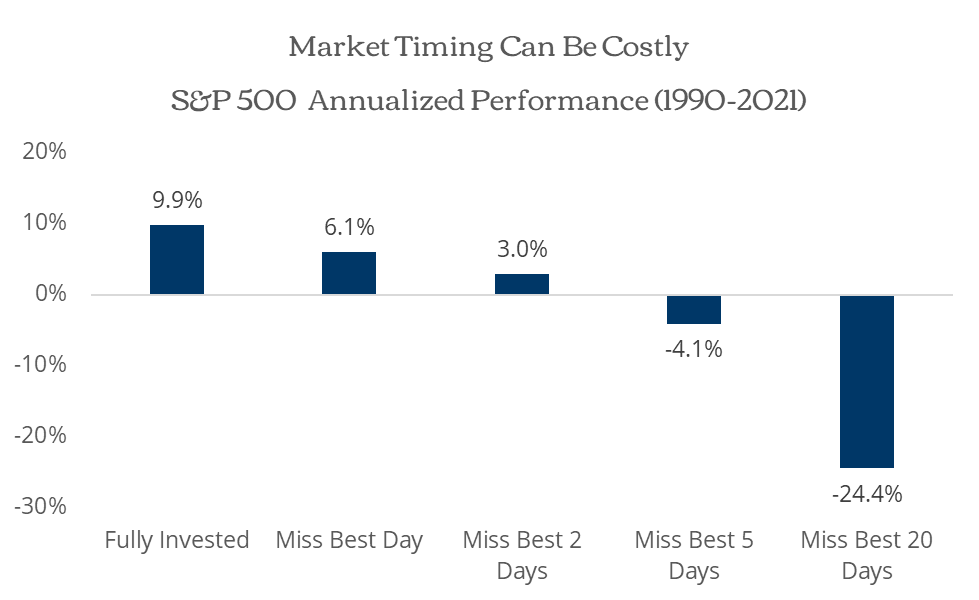

3) Not being invested can be costly.

The market’s largest gains and largest losses often occur within days of each other. Investors moving to cash risk missing out on some of the market’s best days. Just how costly can this be? The annualized gain for the S&P 500 from 1990 to 2021 was 9.9%. Yet, if an investor missed only the best day of each year, that annualized return dropped to 6.1%, a difference of 3.8%. If they missed the best two days of each year, they would be up less than 3% annually. Taking it to the extreme, if the investor missed the best 20 days of each year, they would be down 24.4% per year. See the chart below.3

While most people view risk as volatility (prices going down)…

… We view risk as not reaching your goals.

Most clients have multi-year or multi-decade time horizons. Markets can (and will) be very painful for months or years at a time. It is our job to help clients through trying times and to avoid financial mistakes that can derail a long-term financial plan.

While selling investments and moving to cash can feel like the “safe thing to do”, it could result in a different type of risk – the risk of not reaching your goals.

Sources

- “Winning In The Market With The Patience Of The Wright Brothers And Warren Buffett” Forbes, January 2018

- P. Morgan Asset Management’s “Guide to the Markets”, June 2022

- LPL Research

Disclosures

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations. There is no assurance that strategies discussed are suitable for all investors. Past performance is no guarantee of future results. The S&P 500 index is unmanaged and not directly investable.